Do your homework and ensure the moneylender is licensed. Each term must be thought out carefully and drafted clearly to avoid being construed to be a moneylending business under the Moneylenders Act 1951.

We Are A Licensed Cof Financial Services Limited Facebook

This has thus led to an increase in money lending.

. Loan sharks or often known as Ah Longs are illegal moneylender that impose high interest for payback. Section 27 of the Act requires that your loan agreement be witnessed by a lawyer a legal officer a Commissioner for Oaths or any other authorized person while Section 8d which makes it illegal for licensed moneylenders to loan money to people under 18 years of age. It was operated in small scales by moneylenders who are commonly known as chettys.

While most people are only aware of illegal money lenders or ah longs as they are commonly known in Malaysia there are legal money lenders who operate under licenses issued by the Ministry of Housing and Local Government KPKT. In most cases the borrowers are unable to pay back and illegal or violent methods to. On 13 November 2020 the Ministry of Housing and Local Government KPKT released new guidelines that allow licensed moneylenders credit community companies to apply to provide loans online Online Moneylending Guidelines or Guidelines from 13 May 2021.

It is important that a friendly loan agreement reflects accurately the nature of a friendly loan. Of moneylending in Malaysia. A license to lend money is not issued by Bank Negara Malaysia which is responsible for the countrys financial system.

The money lending business in Malaysia has been in existence since before independence. It has gone through a major amendment in 2003. This is a no.

For repeat offenders there will be whipping in addition to the fine andor. The Malaysian Money Lenders Association was established on 14th August 2003. The Anti-Money Laundering Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 AMLA is the primary piece of AMLCFT legislation in Malaysia.

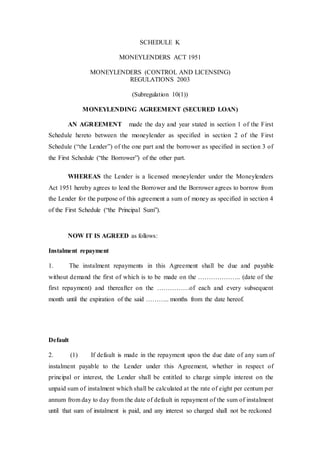

This means that there are certain laws and regulations that ensure that you are not at a disadvantage when you borrow from these parties. WHEREAS the Lender is a licensed moneylender under the Moneylenders Act 1951 hereby agrees to lend the Borrower and the Borrower agrees to borrow from the Lender for the purpose of this agreement a sum of money as specified in section 4 of the First Schedule the Principal Sum. A properly drafted friendly loan agreement will also avoid unnecessary dispute and could.

Besides the Act there were also two regulations enacted in the same year. Moneylending prohibited - The Malaysian Bar. There hasnt been any significant revisions or changes.

First check the list of registered licensed moneylenders. A failure to comply with the Moneylenders Act 1951 may result in the moneylending agreement becoming void and unenforceable or may even attract criminal prosecution. The limitation period for a recovery of loan is 6 years from the date of repayment.

Moneylending is very often confused with loan sharks. In other words you have 6 years to start a legal action against your debtor from the date of repayment failing which you will lose your right to recover the money. At the same time licensed moneylenders can only charge a maximum of 12 interest per year for secured loans putting something valuable you have as a deposit for the loan and 18 interest per year for unsecured ones.

It is conduct unbefitting of an Advocate and Solicitor to charge interest on monies expended on hisher clients behalf or on monies advanced for hisher clients use save for disbursements expended or advanced specifically or solely for the transaction or matter. The Money Laundering Prevention and Prohibition Act 2022 was signed into law by President Mohammadu Buhari on the 12th of May 2022. 4 MONEY LENDING Mmeylend- b8aenU.

Money lending is a legal business which should be registered under Licensed Money Lenders. The Online Moneylending Guidelines which are currently only. In Malaysia borrowing money from licensed moneylenders are governed under the Moneylenders Act 1951.

Get an RM10 discount by calling 03-40479000. Many moneylenders I have seen will use the template loan agreement provided in one of the schedules inside the. In the event there is no fixed date for repayment of the loan limitation runs from the date of.

The Moneylenders Act 1951 contains numerous requirements and prohibitions that apply to licensed moneylenders and these requirements and prohibitions must be strictly adhered to. The lender may also be prosecuted for an offence under Section 5 of the Moneylenders Act 1951. A bit about the moneylending and the new online moneylending guidelines in Malaysia.

This is provided in Section 17A of the MA. The money lending business in Malaysia has been in existence since before independence. The Malaysian Moneylenders Amendment Act 2003 Act A1193 of 2003 MLA 2003 was gazetted on 29 May 2003 while enforcement took effect on 1 November 2003.

Act 1951 MLA 1951 online money lenders are. The Malaysian Money Lenders Association was established on 14th August 2003. Here are some pointers.

21 April 2021. The Act defines the offenses of money laundering and the financing of terrorism and sets out the measures that financial institutions must take to detect. Of the money laundering provisions of the Act about the designated Non-Financial businesses and professions.

The Moneylender Act has been around since pre-independence since it got enacted in 1951. NOW IT IS AGREED as follows. It was operated in small scales by moneylenders who are commonly known as chettys.

The Economic and Financial Crimes Commission for effective implementation. In Malaysia the Moneylenders Act 1951 governs the process of lending money with interest. Money lending is a legal business which should be registered under Licensed Money Lenders.

741 Where any document issued or published by or on behalf of a lender of money purports to indicate the terms of interest upon which he is willing to make loans or any particular loan the document shall express the interest proposed to be charged in terms of a rate per centum per annum. Those found to be in violation of the Act they will be fined for not less than RM250000 but not more than RM1000000 or imprisonment for no more than 5 years or both. Financial institutions that lend money are overseen by the Moneylenders Act 1951 which is handled by the Ministry of Urban Wellbeing Housing and Local Government.

Moneylending In Malaysia Are Friendly Loans Allowed Bryan Co

Statutory Rights And Duties Of The Parties Under The Malaysian

Licensed Moneylender In Kl Pj About 96 Speed Loan

Money Lending Form Borang Pinjaman Wang Money Lenders Act 1951 Schedule J Money Lending Agreement Form Shopee Malaysia

Malaysian Punjabi Licensed Moneylenders Donate To Tabung Harapan

About Malaysian Licensed Moneylenders Association Milma

Malaysian Punjabi Moneylenders Association Thriving Six Decades Later Asia Samachar

Beware Of Fraud Money Lending Licence Bnm

Think Twice Before Lending Money Thomas Philip Advocates And Solicitors Kuala Lumpur Malaysia

Lending To Associated Company Moneylenders Act 1951 Standpoint

3 Important Provisions Under The Moneylenders Act 1951 That May Void A Moneylending Agreement Bryan Co

Exhibit On Moneylending Agreement

Regulating Money Lending In Malaysia Kinibiz

Exhibit On Moneylending Agreement

How To Start Your Licensed Money Lending Business Fortune My

Malaysian Punjabi Moneylenders Association Thriving Six Decades Later Asia Samachar

Moneylenders Act 1951 Act 400 Regulations Marsden Professional Law Book